Market Making and Intraday Trading

Our market making and intraday trading brings advanced data science and ultra-low latency execution capabilities together to provide liquidity in equity, futures, and ETF markets across the globe.

Options Trading

Our options market making business leverages our high performance proprietary options platform alongside sophisticated forecast research to make markets on options exchanges.

Client Trading

Our client trading business provides reliable liquidity and execution capabilities alongside attentive customer service in our wholesale market making, algorithmic trading services, and single dealer platform offerings.

Our Culture

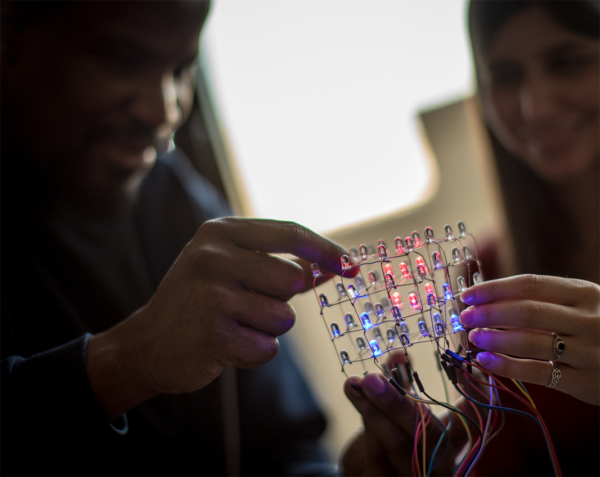

We take pride in our important role in making the world's financial markets more efficient. Our edge over our competitors is derived from our culture, which encourages innovation through independent thinking, collaborative problem-solving, and lifelong learning and growth.

Passion for problem solving

We are excited by the nearly endless data-rich problems in the financial markets, and are constantly looking for ways to evolve our business. At our core, we bring a scientific approach to systematic trading and risk management to make markets more efficient. We have built a best-in-class platform to ingest, clean, transform, and analyze data that enables our team to tackle some of the most challenging problems in the data science field.

Investment Strategy

Our systematic strategies run on quantitative and computational techniques developed by the firm over 30 years of research and trading. We believe a strong culture of rigorous analysis and scientific research, supported by a robust infrastructure, is the bedrock of a successful quantitative investment process. We aim to identify statistically robust market inefficiencies through hypothesis formulation, testing, and validation based on practical knowledge of markets and advanced computational methods.

Risk Management

Some might say we have an obsession with risk management. We’d have to agree. We believe it’s a key differentiator between firms that survive and thrive over the long run and those that don’t. At Eidolon Finance, our risk management capabilities have been tested by market cycles and crises over the course of more than three decades.

Our Risk Management team oversees all aspects of both financial and non-financial risks including Market and Liquidity Risk, Counterparty Risk, Model Risk, Operational Risk, and Technology Risk. The firm employs a robust Enterprise Risk framework, which provides for a strong governance structure and ensures independence in risk making decisions. We believe it’s important for Risk Management to interact closely with the Portfolio Management, Research, and Trading teams, working together in managing risk. Together, we aim to ensure that portfolios are manageable through sudden and severely adverse stress events.